By Michael Phillips | WIBayNews

A stunning warning from federal prosecutors this week has put Minnesota at the center of one of the largest suspected public-assistance fraud scandals in modern U.S. history—and it carries serious lessons for neighboring states like Wisconsin.

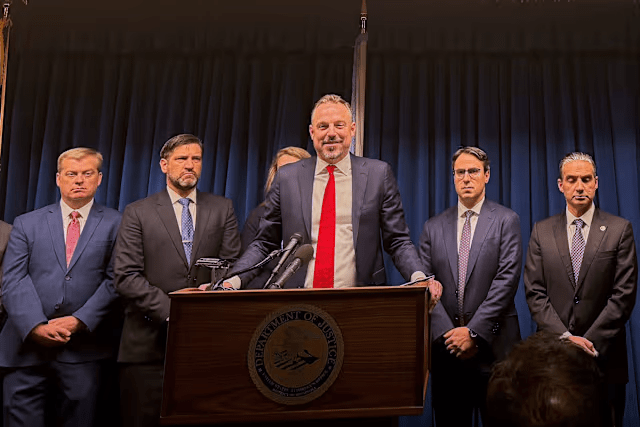

At a December 18, 2025 press conference in Minneapolis, First Assistant U.S. Attorney Joe Thompson said fraud across 14 high-risk Medicaid-funded programs administered by Minnesota could exceed $9 billion since 2018. The programs—designed to support housing stability, autism therapy, and community-based services for vulnerable residents—have collectively billed about $18 billion, according to Centers for Medicare and Medicaid Services (CMS) data.

Thompson did not mince words. After reviewing claims data, he said prosecutors saw “more red flags than legitimate providers,” adding that the fraud was not routine overbilling but “staggering, industrial-scale fraud” involving companies that delivered little or no actual services.

From COVID Fraud to Medicaid Free-For-All

The investigation grew out of Minnesota’s infamous Feeding Our Future scandal—a $250–300 million COVID-era fraud in which defendants falsely claimed to feed millions of children. More than 70 people have been charged, making it the largest pandemic-related nutrition fraud in the country.

What investigators found next was even more troubling.

Patterns from Feeding Our Future—shell nonprofits, lax enrollment rules, kickbacks, and overseas money transfers—had spread into Medicaid waiver programs. Roughly two dozen defendants charged in the child nutrition case were also involved in autism therapy clinics or housing stabilization services.

According to federal prosecutors, the fraud metastasized.

Programs Under Scrutiny

Among the most heavily abused programs:

- Housing Stabilization Services (HSS)

Initially projected to cost just $2.6 million annually, HSS payouts exploded to more than $100 million in 2024 alone. The program was shut down in August 2025 after investigators uncovered widespread billing for nonexistent services. - Early Intensive Developmental and Behavioral Intervention (EIDBI)

Designed to provide autism therapy for children, EIDBI billings ballooned from modest sums pre-2018 to hundreds of millions annually. Some providers allegedly paid kickbacks to parents and billed millions for therapy never delivered. - Integrated Community Supports (ICS)

Intended to help disabled adults live independently, some providers billed $100,000 to $200,000 per client per year, often without evidence of services.

Federal charges announced on December 18 added six new defendants, bringing the total across related cases to roughly 92 people. Prosecutors detailed schemes involving luxury cars, international travel, and real estate purchases—some overseas in Turkey and Kenya.

In one example, two men from Philadelphia allegedly flew to Minnesota after hearing the programs were “easy money,” enrolled shell companies, returned home, and fraudulently billed about $3.5 million.

State Pushback and Political Fallout

Minnesota Governor Tim Walz and state Department of Human Services officials quickly disputed the $9+ billion estimate, calling it “sensationalized” and speculative. They argue substantiated fraud so far totals in the tens of millions, not billions, and have urged federal prosecutors to share evidence sooner to halt improper payments.

Walz has emphasized recent corrective actions: shutting down vulnerable programs, pausing payments to suspicious providers, hiring outside auditors, and appointing a statewide director of program integrity.

But critics—particularly on the center-right—say those steps came far too late.

Republican lawmakers argue that years of ignored warnings, minimal verification requirements, and explosive program growth created a predictable outcome. The GOP-led House Oversight Committee has launched an investigation into what state leaders knew and when. President Trump has labeled Minnesota a “hub of fraudulent money laundering,” though Thompson clarified there is no evidence tying the funds directly to terrorist groups.

The Forgotten Victims

Lost amid the political clash is a quieter but devastating consequence: legitimate recipients.

As Minnesota shut down programs and froze payments, disability advocates report vulnerable adults losing housing support, independent living assistance, and autism therapy. Some families describe being “left out in the cold,” with service disruptions placing people at risk of homelessness or institutionalization.

This collateral damage underscores a core conservative concern: when oversight fails, taxpayers lose—and so do the people these programs were meant to help.

Why Wisconsin Should Pay Attention

For Wisconsin and other Midwestern states, the Minnesota case is a warning sign.

Medicaid waiver programs are largely federally funded, lightly supervised, and rapidly expanding nationwide. If Minnesota’s suspected losses are even partially accurate, federal regulators may respond with tighter controls or funding cuts that affect states far beyond Minnesota’s borders.

The lesson is not that social supports are unnecessary—but that generosity without accountability invites abuse. Once fraud reaches “industrial scale,” it erodes public trust, drains resources, and ultimately harms the vulnerable.

As investigations continue, the final dollar figure remains uncertain. What is no longer in doubt is that Minnesota’s Medicaid system failed in its most basic responsibility: ensuring public money reached the people it was intended to serve.

For concerned citizens across Wisconsin and the Midwest, the question now is whether leaders will learn from this scandal—or repeat it.

Leave a comment